How Much Is Car Insurance Per Month?

If you are looking for a car insurance policy, you're probably overwhelmed with numbers, prices, rates, and everything that's involved in this process. We're going to help you out throughout the following post. Here, you'll learn how much is car insurance per month, factors that play a role in car insurance rates, and much more.

What is the average annual premium?

The average annual car insurance premium in the United States is $1,548. In other words, the average 6-month premium is $774. On a monthly basis, the car insurance premium equals $129.

The costs of car insurance coverage have increased by 5% compared to 2019. In 2019, the annual premium was $1,470 on average, i.e., a 6-month premium of $735 or $122 a month.

The annual or monthly premium is not the same for everyone as multiple factors play a role. Read on to learn more.

Factors that affect car insurance rates

Car insurance premium rates depend on numerous factors, some of which are more well-known than others. Car insurance companies take into account multiple risks or rating factors that affect the probability of a client placing a claim. Below is a brief rundown that may influence each car owner’s insurance rates.

Location

Car insurers tend to ask for a client's ZIP code first because the location is the first (and probably the most important) factor for base rates. Based on the ZIP code, insurance companies can check accident rates, the rate of stolen cars, vandalism cases, number of claims (and fraudulent claims), and other factors. This information helps them to discern the risks linked with insuring a client and their car in a specific location. Keep in mind that location is not the main factor in some states, such as California.

Age

Generally speaking, the younger the driver, the higher the rates are. The reason is simple, young and especially novice drivers tend to be reckless and more prone to accidents. Young drivers are the riskiest category to insure, but the rates generally decrease for people who are 25 or older.

Gender

Average car insurance rates also depend on the gender of a driver. Crash statistics vary between genders, and they influence the price of car insurance. Since men are more likely to crash and engage in riskier behaviors on the road, their insurance rates are higher at the beginning. With age, the rates decrease, and in some cases, women have higher car insurance rates than men. States such as Massachusetts, Hawaii, Michigan, Montana, Pennsylvania, and North Carolina do not allow gender to affect insurance rates.

Marital status

Statistically speaking, married couples are less of a risk to insurance companies than single men and women, including divorced and widowed drivers too. Compared to single drivers, married people tend to be less active and more careful on the road. Some statues, however, don’t allow insurance companies to base their rates on marital status. They include Hawaii, Massachusetts, Michigan, and Montana.

Driving experience

Inexperienced drivers are risky to insure, so their rates are higher. Regardless of age, any person who hasn't driven a car before is automatically considered to be a higher risk than experienced counterparts.

Driving record

How safe a driver is on the road is important for insurance companies. Behavior on the road directly affects a risk to an insurer. Drivers with a clean driver’s history qualify for better rates and are also eligible for discounts. On the flip side, drivers prone to accidents and moving violations pay higher insurance rates.

Claims record

Insurance companies also gather reports on claims a driver has made with them or previous car insurers. At-fault claims tend to result in a surcharge, but not-at-fault collisions and comprehensive claims may not. Car insurance companies also analyze how much was paid out to a driver who made a claim. There’s usually a limit, under which they don’t pay a surcharge.

Credit history

Drivers with lower credit scores (usually below 600) are more likely to file more claims and even commit insurance fraud. Low credit score, in some states, leads to a higher insurance rate. States that prohibit the use of credit history as a factor include California, Hawaii, Massachusetts, and Michigan.

Previous insurance

Having continual car insurance can help a driver get a better rate. Insurance companies find that drivers without a lapse in their coverage are less likely to get into an accident. Generally speaking, it’s not important whether a person’s previous car insurance was provided by the same insurer or a different company. However, many insurers offer loyalty discounts to clients who get coverage from them continuously.

Type of vehicle

If the insurer’s calculations show a certain type of vehicle has more accidents or is involved in more claims, the rates go up. The purchase price, theft rate, cost of repairs, safety tests, and accident rates also play a role in the price of car insurance premiums.

Purpose/use of cars

Personal use of car costs less than business use. The latter has higher driving time and is more likely to have accidents, so their rates are higher.

Mileage per year

The logic is simple – the fewer someone drives, the lower the risk of getting into accidents. As a result, the rates are lower too. If the annual mileage decreases, it's useful to inform the insurance provider in order to save money.

Coverage and deductible

Multiple types of coverage with higher limits lead to increased rates. That happens because the insurer is taking additional risks by giving a driver more coverage. The main coverage components of a policy include liability, uninsured/underinsured motorist, collision and comprehensive, and medical payments or personal injury protection (PIP).

Rates by states

Since locations play a crucial role in average car insurance rates, below is the rundown of average car insurance costs for full and minimum coverage in each state and Washington D.C. These rates are the average annual premium for a policy across insurers.

|

State |

Full coverage |

Minimum coverage |

Annual difference |

|

Michigan |

$8,723 |

$5,282 |

$3,441 |

|

Rhode Island |

$3,847 |

$1,589 |

$2,258 |

|

Louisiana |

$3,525 |

$1,329 |

$2,196 |

|

Kentucky |

$3,418 |

$1,338 |

$2,079 |

|

Florida |

$3,370 |

$2,565 |

$805 |

|

Nevada |

$3,190 |

$1,295 |

$1,895 |

|

Colorado |

$3,164 |

$1,075 |

$2,089 |

|

New Jersey |

$3,013 |

$1,182 |

$1,831 |

|

Washington D.C. |

$2,793 |

$1,260 |

$1,533 |

|

New York |

$2,752 |

$1,323 |

$1,429 |

|

Arizona |

$2,699 |

$980 |

$1,719 |

|

Oklahoma |

$2,659 |

$742 |

$1,916 |

|

Connecticut |

$2,619 |

$1,192 |

$1,428 |

|

Georgia |

$2,619 |

$1,114 |

$1,505 |

|

Texas |

$2,594 |

$890 |

$1,704 |

|

Missouri |

$2,584 |

$874 |

$1,710 |

|

Utah |

$2,538 |

$1,105 |

$1,433 |

|

Montana |

$2,525 |

$641 |

$1,884 |

|

Delaware |

$2,513 |

$1,316 |

$1,197 |

|

Maryland |

$2,431 |

$1,180 |

$1,251 |

|

South Dakota |

$2,338 |

$420 |

$1,917 |

|

Illinois |

$2,313 |

$878 |

$1,435 |

|

Minnesota |

$2,271 |

$983 |

$1,289 |

|

Arkansas |

$2,213 |

$677 |

$1,536 |

|

Mississippi |

$2,208 |

$749 |

$1,459 |

|

Oregon |

$2,205 |

$1,136 |

$1,070 |

|

New Mexico |

$2,194 |

$699 |

$1,495 |

|

Kansas |

$2,190 |

$654 |

$1,535 |

|

West Virginia |

$2,131 |

$685 |

$1,447 |

|

Wyoming |

$2,118 |

$485 |

$1,632 |

|

Alabama |

$2,078 |

$736 |

$1,342 |

|

Nebraska |

$2,038 |

$599 |

$1,439 |

|

Pennsylvania |

$2,018 |

$615 |

$1,403 |

|

South Carolina |

$2,013 |

$854 |

$1,158 |

|

New Hampshire |

$2,004 |

$643 |

$1,361 |

|

North Dakota |

$1,979 |

$528 |

$1,451 |

|

Massachusetts |

$1,866 |

$646 |

$1,219 |

|

Tennessee |

$1,821 |

$577 |

$1,243 |

|

California |

$1,804 |

$574 |

$1,230 |

|

Idaho |

$1,777 |

$606 |

$1,171 |

|

Vermont |

$1,769 |

$552 |

$1,217 |

|

Washington |

$1,691 |

$706 |

$985 |

|

Ohio |

$1,688 |

$561 |

$1,127 |

|

Wisconsin |

$1,590 |

$486 |

$1,104 |

|

Alaska |

$1,502 |

$485 |

$1,016 |

|

Virginia |

$1,498 |

$607 |

$891 |

|

Indiana |

$1,489 |

$498 |

$991 |

|

Iowa |

$1,482 |

$357 |

$1,124 |

|

North Carolina |

$1,434 |

$542 |

$892 |

|

Hawaii |

$1,340 |

$475 |

$865 |

|

Maine |

$1,268 |

$489 |

$779 |

Generally speaking, the cost of car insurance is most affordable in Maine, where the minimum coverage is $489 or $41 per month.

The most expensive state for car insurance coverage in Michigan, where minimum coverage is $5,282 per year or $440 a month. Rhode Island residents pay on average $1,589 for minimum coverage, which equals to $132 on a monthly basis.

In New York, the minimum coverage is $1,323 or $110 a month, while in California, the minimum insurance coverage is $574 or $47 per month.

The average costs vary from one state to another but are also influenced by other factors, which were elaborated above.

Rates by age

A 30-year-old driver generally pays lower insurance rates than their 18-year-old counterpart. The latter is considered less responsible and more irresponsible on the road. Below is the diagram with average six-month and monthly premiums across different age groups.

Car insurance premium rates are the highest for the youngest drivers, but after the age of 59, they also tend to increase. The reason is simple – the older the driver, the bigger is the risk of accidents on the road due to many factors, including health problems and vision disturbances.

Rates by gender

In many states, gender has a major impact on insurance rates, but in others, this factor is irrelevant. The difference in insurance rate becomes non-significant around the age of 30, but for teens, it’s massive.

For example, an 18-year-old female driver has an annual car insurance premium of $6,797, while her male counterpart has a rate of $7,561.

The difference in car insurance premiums between the two genders is $764.

The average six-month premium for 18-year-old females and males is $3,398 and $3,780, respectively.

That would mean the monthly rate for 18-year-old male drivers is $630 on average, while for females, it's $566.

Rates by vehicle

The type of vehicle is crucial for the total cost of insurance coverage. Vehicles generate premiums according to VIN (vehicle identification number), which insurers use to evaluate accident history, mileage, and other important factors. The table below demonstrates the average car insurance rates (annual, six-month, and monthly) based on the type of vehicle a driver owns.

|

Type of vehicle |

Annual premium |

6-month premium |

Monthly premium |

|

Sedan |

$2,274 |

$1,137 |

$189.5 |

|

Luxury |

$2,090 |

$1,045 |

$174 |

|

Green |

$2,110 |

$1,055 |

$175 |

|

Van |

$1,688 |

$844 |

$140 |

|

SUV |

$1,934 |

$967 |

$161 |

|

Truck |

$1,730 |

$865 |

$144 |

Rates by driving record

How a driver behaves on the road directly influences the car insurance premiums. Most car insurance companies increase their rates for three to five years after any speeding ticket, accident, and other kinds of violation. Below is the tabular representation of insurance coverage before and after an at-fault car crash alongside the annual difference.

|

Policy |

Perfect driving record |

One at-fault accident |

Annual difference |

|

Full coverage |

$1,427 |

$2,146 |

$719 |

|

Minimum coverage |

$606 |

$910 |

$304 |

The full coverage policy increases on average to $1,781 after one speeding ticket, which makes the annual difference of $355. On the other hand, minimum coverage rises to $755 after a speeding ticket and results in an annual difference of $148 on average.

Generally speaking, the bigger the violation, the higher the increase in the cost of car insurance gets. After a DUI, the insurance rate may increase by up to 77%. For example, a 40-year-old driver with average car insurance with full coverage may get a rate of $2,531 after a recent DUI. That’s a $1,104 annual difference compared to a perfect driving record rate of an average of $1,427. The same driver with minimum coverage may face a $1,079 car insurance rate after a DUI, i.e., $473 higher than a counterpart with a clean driving history.

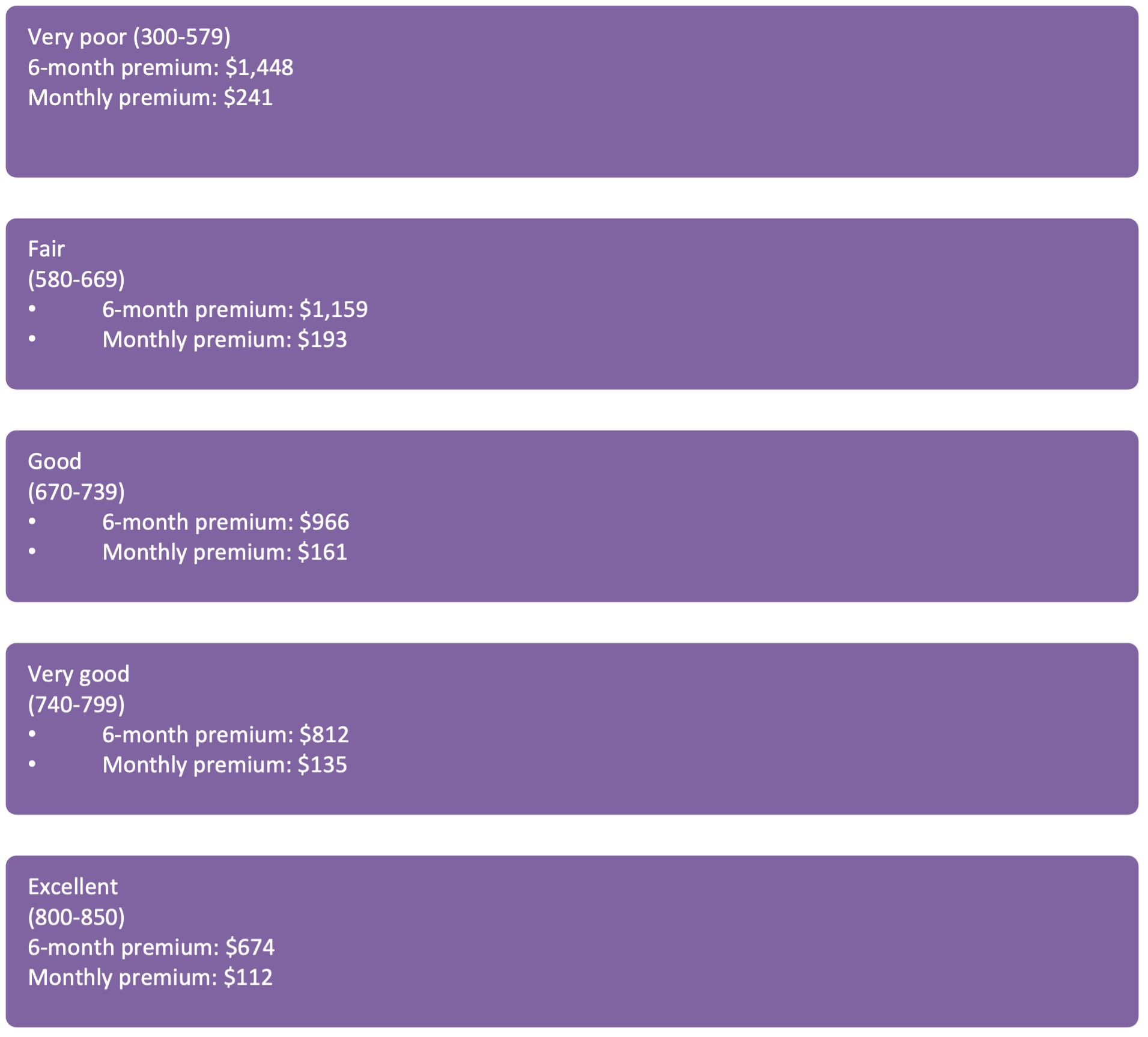

Rates by credit

In almost all states, the credit score is an important segment of the car insurance premium rate. The credit score's impact on the premium rate depends on the location of the driver and the insurance company. The average difference between excellent and very poor credit is $774. The diagram below demonstrates average 6-month and monthly premiums based on the credit score of a driver.

Rates by marital status

Marital status matters for many insurance providers in most states. The average annual full coverage car insurance rates for married couples are $2,881, while their single counterparts tend to pay more. The average rate for widowed men and women is $2,925, and for divorced $2,990, while single drivers who have never been married have an average insurance rate of $2,991.

Rates by the insurance company

The cost of car insurance greatly depends on the provider alongside other factors. Location and driving history are major determinants of car insurance premiums, but the table below shows the average rates at some of the biggest auto insurers in the country.

|

Company |

Full coverage |

Minimum coverage |

|

Allstate |

$3,545 |

$1,390 |

|

USAA |

$1,307 |

$430 |

|

GEICO |

$2,158 |

$819 |

|

MetLife |

$2,447 |

$971 |

|

Farmers |

$4,280 |

$1,469 |

|

Nationwide |

$2,293 |

$1,004 |

|

StateFarm |

$1,737 |

$712 |

|

American Family |

$2,041 |

$811 |

|

Progressive |

$2,393 |

$924 |

|

Auto-Owners Insurance |

$2,112 |

$649 |

The above-presented rates depend on driving history, other personal info, and whether the type of insurance is full coverage or minimum.

How to learn the exact price of car insurance?

As seen throughout this post, multiple factors determine car insurance premiums. No fixed price applies to everyone, which is why the post focused on average premium costs. The best way to learn the specific costs of car insurance coverage for each driver individually is to use the OfficialCarInsurance.com platform. The service allows users to apply for quotes from multiple car insurance carriers and compare their premium offers.